Chile presents the results of the Shopper Experience Observatory (OSE), organized in collaboration with Ipsos, marking the fifth edition in the country. The results were showcased at an event attended by more than 30 brands and 90 participants, where the main insights into the Chilean market and shoppers were shared.

The fifth edition of the Shopper Experience Observatory (OSE) in Chile, organized in collaboration with Ipsos, gathered over 30 brands and 90 attendees. During the event, significant insights were shared about the behavior of Chilean shoppers in an economic context marked by inflation and uncertainty.

The study, based on an online survey of 350 shoppers from the IPSOS panel, highlights how the current economic situation is affecting shopping habits in supermarkets. 90% of respondents perceive that their spending has increased compared to last year, and 80% rate Chile’s economic situation as “fair or poor”. With more than 75% of shoppers expecting no improvement in the coming year, consumption habits have begun to restructure.

In an economic environment where Chile’s Consumer Confidence Index remains low, albeit with a slight increase to 42.7 in June 2024, consumption is shifting, and shoppers are adopting new behavioral patterns.

Key findings of OSE Chile 2024:

Increased frequency of supermarket visits

Despite spending restraints, physical retail remains the preferred channel for shopping, with 90% of respondents making household purchases in this channel. Additionally, inflation has caused a shift in shopping frequency: 58% of shoppers visit the supermarket one or more times per week, compared to 46% in 2021. Purchases are now more frequent but smaller in size.. Además, la inflación ha generado un cambio en la frecuencia de compra: el 58% de los shoppers visita el supermercado una o más veces por semana, frente al 46% registrado en 2021. Las compras son ahora más frecuentes, pero de menor tamaño.

Focus on in-home consumption

In this new inflationary landscape, Chilean households prioritize saving. 65% of respondents plan to reduce spending on vacations, and 62% will do the same with food delivery apps. Conversely, 59% of shoppers intend to maintain or even increase spending on hosting meals at home.

More demanding and attentive shoppers

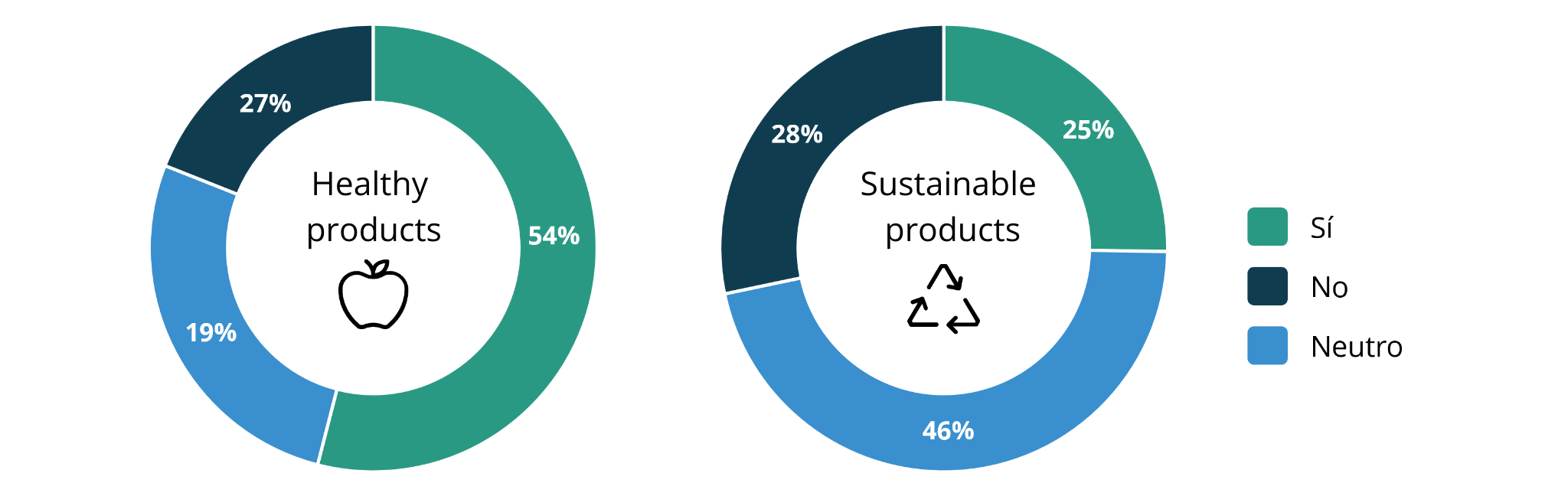

73% of shoppers are cautious to avoid products with warning labels, and 54% are willing to pay more for healthier products. However, only 25% would pay extra for sustainable products, indicating that while sustainability is important, price remains a key factor in purchasing decisions.

- Graph 1: Willingness to pay more

Point-of-sale decisions

Despite increased pre-purchase planning, 90% of respondents say they make their purchase decisions partially or entirely once in the supermarket. This underscores the importance of the in-store environment as a decisive factor in shopping.

Greater openness to innovation and less brand loyalty

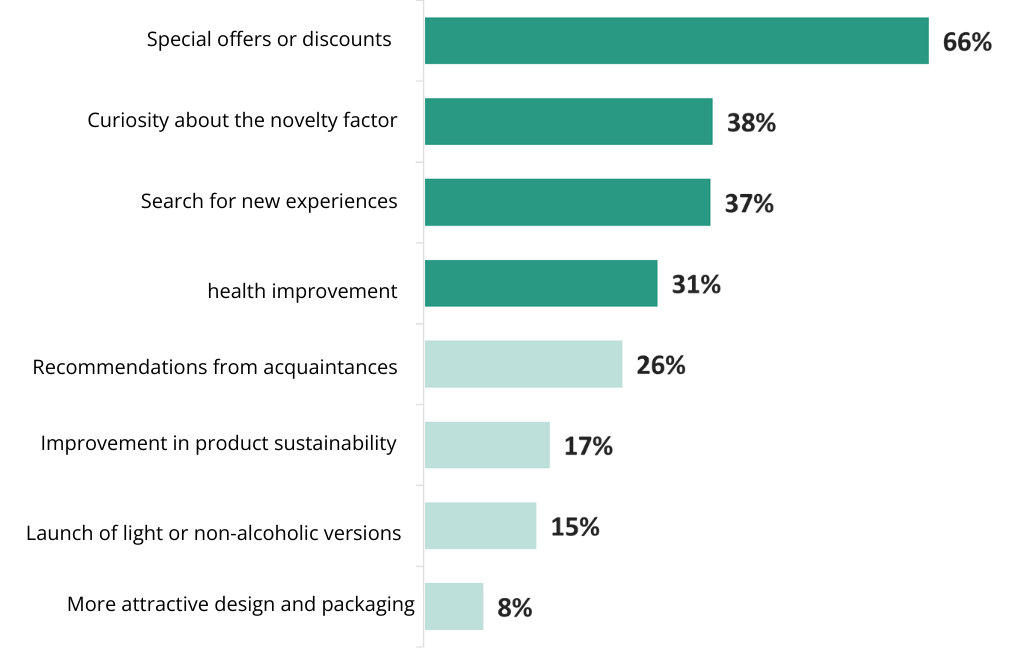

Although the economic situation is challenging, 90% of shoppers report being willing to try new products. Additionally, only 25% of respondents consider themselves loyal to brands, opening up a crucial opportunity for innovation and new product launches in the Chilean market.

- Graph 2: Motivation to try a new product

What insights do we draw about the chilean market?

The OSE Chile 2024 results reveal a scenario where shoppers are aware, demanding, and open to change. Households seek ways to reduce spending without giving up on creating enjoyable moments at home. Brands have a key opportunity to connect with this new shopper profile, which prioritizes health, convenience, and is open to trying new products, as long as these offer clear value at the point of sale. With the physical channel remaining the preferred option and decision-making largely occurring in supermarkets, retail media positions itself as a powerful tool to influence purchasing decisions. Events like OSE Chile remain an essential platform for deeply understanding shopper behavior and adapting marketing strategies to the evolving demands of the market.